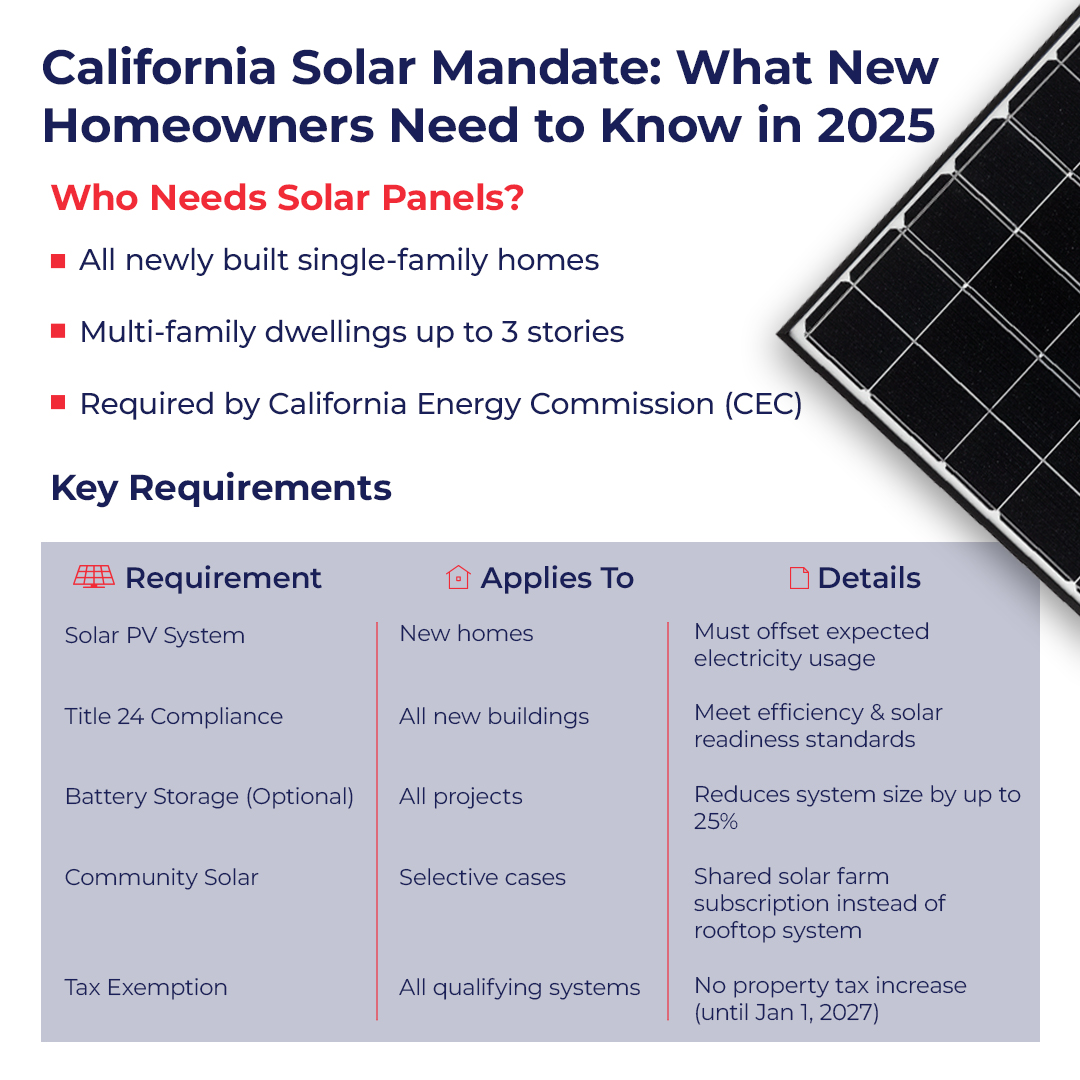

Yes. Most new homes in California must include solar panels. This rule started in 2020 and comes from the state’s Title 24 building code. It applies to new single-family homes and low-rise apartments up to three stories. The solar system must be big enough to meet the home’s expected energy use. Some homes may be exempt if the roof is too small, shaded, or if they join a community solar program.

If you’re buying, building, or selling a home, here’s what you need to know.

The California solar mandate is a rule that says most new homes must include solar power systems.

It started on January 1, 2020, as part of California’s Title 24 Building Code. This code sets rules for saving energy in new buildings.

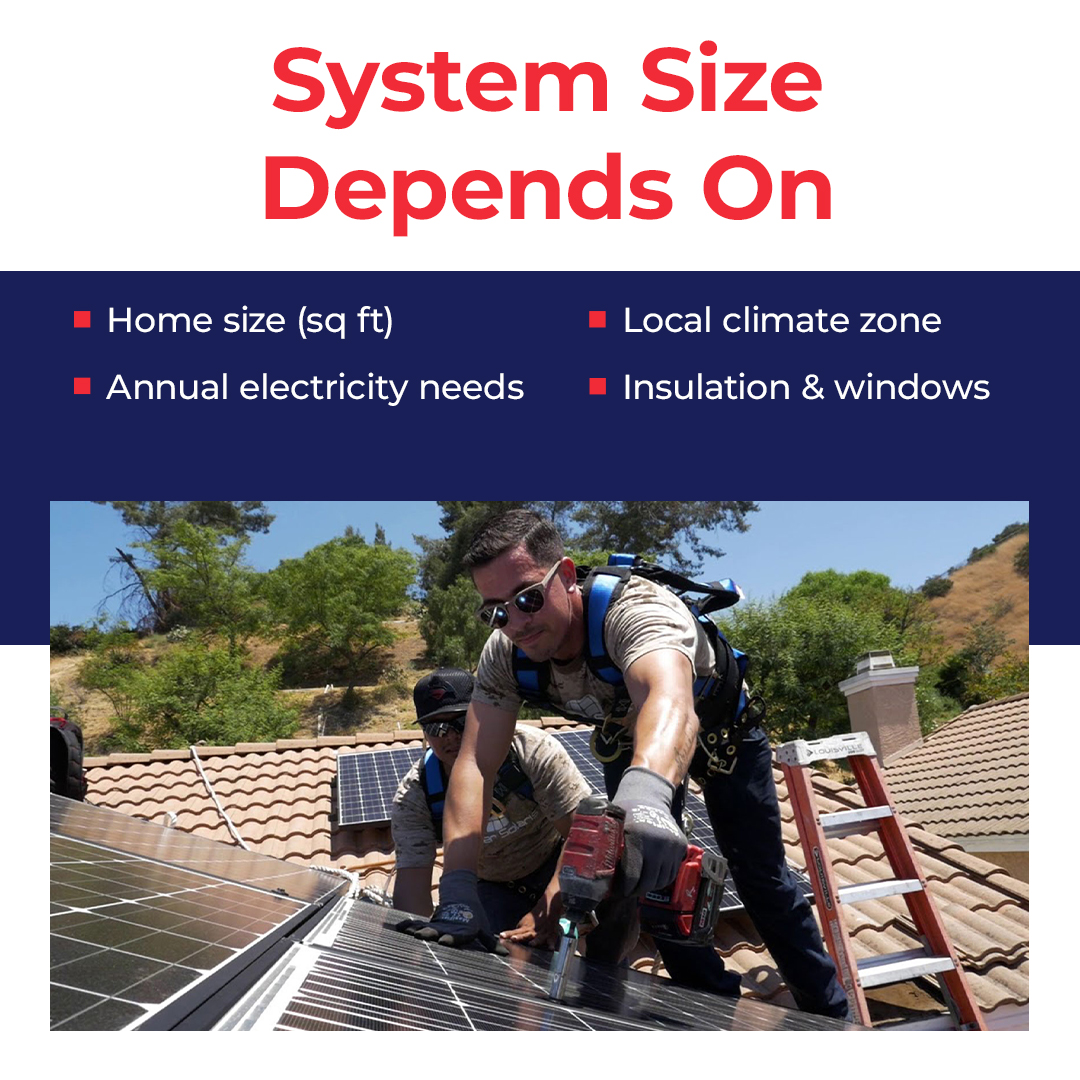

The solar system must cover the home’s expected electricity use for the year. Its size depends on:

The California Energy Commission (CEC) made this rule. Their goal is to:

In 2025, the rule applies to:

These homes must be solar-ready. That means they need the wiring and space to support solar panels. In many cases, they must also support:

Yes. Some homes are exempt if:

Also, builders can sometimes use community solar instead of rooftop panels. These are shared solar farms that serve many homes through a subscription.

No, batteries are not required, but they are a smart upgrade.

Adding a battery, like the Tesla Powerwall or Enphase IQ, can help you:

| Requirement | Applies To | Details |

| Solar Panel System | New single-family and low-rise multi-family homes | Must cover expected yearly electricity use |

| Title 24 Code | All new buildings | Must meet energy-saving standards |

| Battery Storage | Optional | Increases energy use and savings |

| Community Solar | In some cases | Shared solar systems replace rooftop panels |

| Property Tax Break | Most solar systems | Panels don’t raise property taxes until 2027 |

System size depends on:

Builders use tools like the Solar PV Calculator and Solar Assessment Tool to get the right size.

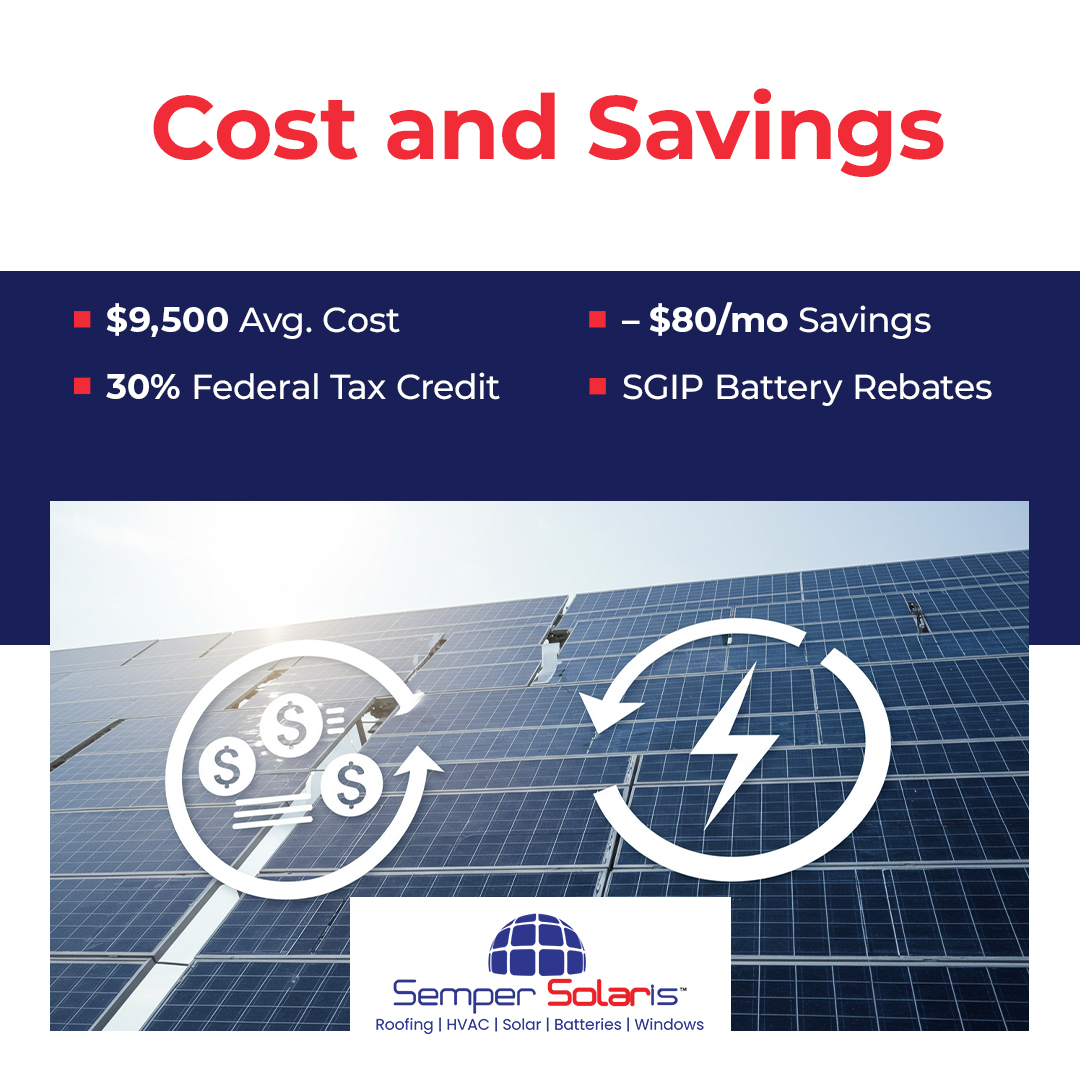

Adding solar to a new home costs around $9,500.

But the average homeowner saves $80/month on electric bills. That’s more than the $40/month added to a mortgage.

Skipping the solar rule can cause:

Local cities and counties are in charge of enforcement.

Yes. Since 2023, the solar rule also applies to some larger buildings:

Batteries are still optional for these, but highly recommended.

No. Homes with solar installed between 1999 and 2026 get a tax break. This rule (called Section 73) means your property taxes won’t go up after adding panels.

Unless lawmakers extend it, this tax break ends January 1, 2027.

California now leads the way in solar energy. The solar rule helps new homes cut bills and reduce pollution. The upfront cost is real, but the long-term savings are big.

Semper Solaris is here to help. We design and install systems that follow every rule, and deliver real results.

Let’s plan your solar system the right way. Get a free quote today.